do you pay taxes when you sell a car in texas

If the buyer is living in another state then the tax would need to be paid in. Whether you actually complete.

How To Transfer My Texas Title Here S How With Examples

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

. Do you have to pay taxes on a car you buy from a private owner in Texas. The minimum is 625 in Texas. The tax is computed on the remaining selling price for the purchased.

Subtract what you sold the car for from the adjusted purchase price. For reference if you meet the criteria and sell your house for 200000 you will have to pay capital gains of 30000. If you are legally able to avoid paying sales tax.

Texas residents 625 percent of sales price less credit for. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. If the seller does not transfer or keep their license plates the license plates must be disposed of by defacing the front of the plates either with permanent black ink or another method in order.

Paying Taxes On Gifted Vehicles. New South Wales Across the border from the ACT stamp duty is based on the higher of either the price paid for the vehicle. Also keep in mind that in the state of Texas the most you.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. To calculate the sales tax on your vehicle find the total sales tax fee for the city. If its a private party purchase they must satisfy the motor vehicle tax within 30 days of the purchase.

However you wont need to pay the tax. If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer. Thus you have to pay.

For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit. Selling a car for more than you have invested in it is considered a capital gain. So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000.

In most states the cars recipient must fill out the bulk of the paperwork and this includes tax paperwork. In Oklahoma the excise tax. Multiply the vehicle price after trade-in andor incentives by the sales tax fee.

You do not need to pay sales tax when you are selling the vehicle. Instead the buyer is. To be eligible the trade-in must be taken as part of the same sales transaction and transferred directly to the seller.

Thankfully the solution to this dilemma is pretty simple. When you sell a car for more than it is worth you do have to pay taxes. Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car.

Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle. The buyer is responsible for paying the sales tax. How much tax do you pay when you sell a car.

Vehicle Title Fraud Explained 6 Proven Ways To Avoid It

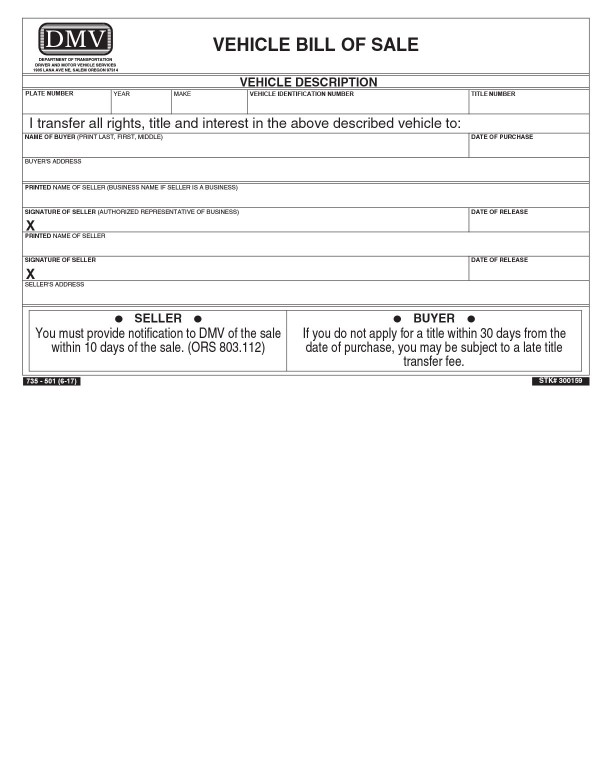

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

Understanding Taxes When Buying And Selling A Car Cargurus

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

Motor Vehicle Galveston County Tx

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

Does Texas Have Trade In Tax Benefits On Used Vehicles

Is Buying A Car Tax Deductible Lendingtree

Sales Tax On Cars And Vehicles In Texas

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How Much Is Tax Title And License In Texas The Freeman Online

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Is Buying A Car Tax Deductible In 2022

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

What New Car Fees Should You Pay Edmunds

Car Tax By State Usa Manual Car Sales Tax Calculator

How To File A Sales Tax Return Electronically As A List Filer Official Youtube